Soaring Uncertainty: US Economy's Uncertain Future

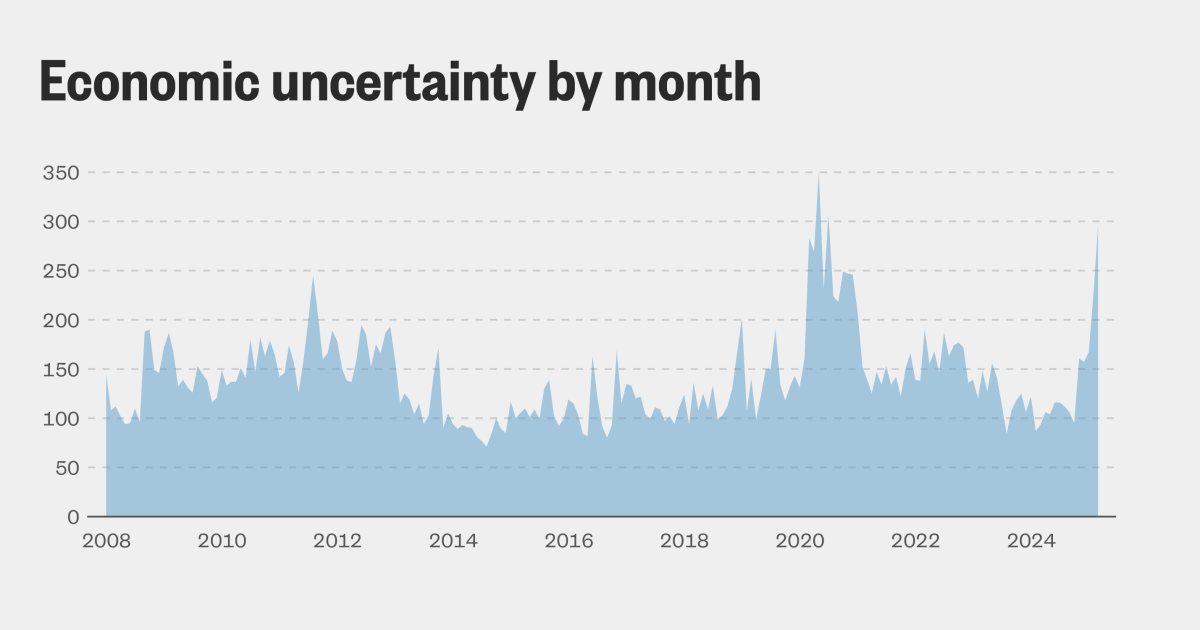

The US economy is facing a period of unprecedented uncertainty. While recent data points to continued growth in certain sectors, underlying vulnerabilities and looming challenges cast a long shadow over the future. This uncertainty is fueled by a confluence of factors, leaving economists and market analysts scrambling to predict the path ahead.

Inflation's Persistent Grip

Inflation, the relentless rise in the price of goods and services, remains a major headwind. While the rate of inflation has slowed from its peak, it still significantly exceeds the Federal Reserve's target of 2%. This persistent inflation is eroding purchasing power, impacting consumer confidence, and forcing the Fed to maintain a hawkish monetary policy – meaning continued interest rate hikes. These hikes, while aimed at curbing inflation, also carry the risk of triggering a recession.

- Rising interest rates: Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing down investment and spending.

- Supply chain disruptions: Although easing, lingering supply chain issues continue to contribute to inflationary pressures.

- Geopolitical instability: The war in Ukraine and escalating tensions in other regions contribute to global economic uncertainty and impact energy and commodity prices.

Recessionary Fears

The persistent inflation and aggressive monetary policy by the Federal Reserve have fueled growing concerns about a potential recession. While the economy has shown resilience in some areas, indicators like inverted yield curves (a classic recession predictor) are raising red flags. The debate among economists centers around the severity and duration of any potential downturn, with some predicting a mild recession while others warn of a more protracted and painful economic contraction.

Job Market: A Mixed Bag

The job market presents a mixed picture. While unemployment remains relatively low, wage growth is not keeping pace with inflation, leaving many workers struggling to make ends meet. Furthermore, the possibility of widespread layoffs in certain sectors, particularly in tech, casts a shadow over future employment prospects. This uncertainty could lead to decreased consumer spending, further hindering economic growth.

The Role of Geopolitics

Global geopolitical instability significantly impacts the US economy. The ongoing war in Ukraine has disrupted energy markets and supply chains, contributing to inflation. Trade tensions with China and other countries also add to the uncertainty. Navigating this complex geopolitical landscape is a crucial factor in determining the future trajectory of the US economy.

Looking Ahead: Navigating the Uncertainty

Predicting the future of the US economy remains a challenging task. The interplay between inflation, interest rates, geopolitical events, and consumer confidence creates a complex and unpredictable environment. Businesses and consumers alike need to carefully monitor economic indicators and adapt their strategies to navigate this period of uncertainty. Diversification, fiscal prudence, and a focus on resilience will be key to weathering the storm.

Call to Action: Stay informed about the latest economic developments by subscribing to our newsletter and following us on social media. Understanding the economic landscape is crucial for making informed financial decisions. What strategies are you employing to navigate this period of uncertainty? Share your thoughts in the comments below.