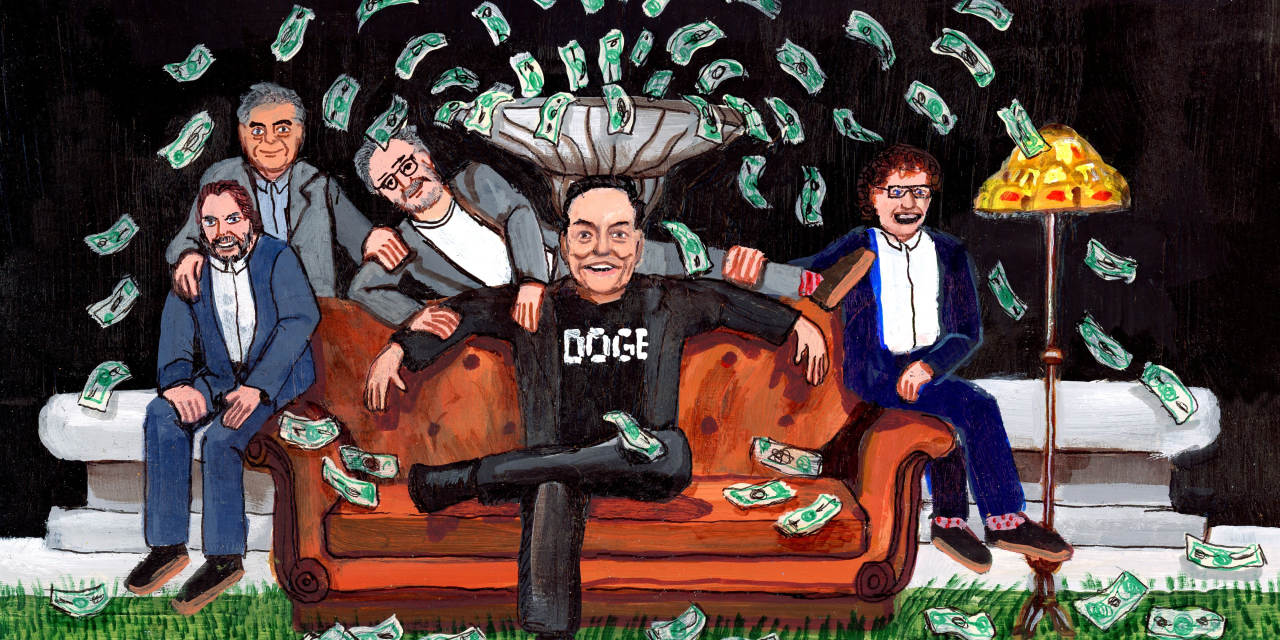

Elon Musk's Friends Cash In: The Perks of Private Company Access

Exclusive access to private companies, particularly those spearheaded by high-profile figures like Elon Musk, is a coveted prize, often leading to significant financial gains. Recent reports highlight how close associates of Musk have leveraged their connections to amass considerable wealth, sparking debates about fairness, transparency, and the potential for conflicts of interest. This article delves into the intricacies of this privileged access and its implications.

The Insider Advantage: How Connections Translate to Profit

The ability to invest in pre-IPO (Initial Public Offering) companies offers substantial potential for returns. These private companies, often operating at the cutting edge of technology, are not accessible to the average investor. However, individuals with close ties to the founders or key executives gain an exclusive window of opportunity. This privileged access allows them to purchase shares at significantly lower valuations than those available to the public after an IPO.

For example, several individuals within Musk's close circle have reportedly benefited from investments in SpaceX and Tesla before their public listings. The exponential growth of these companies has resulted in massive returns for these early investors. While precise figures remain undisclosed in many cases, the scale of these gains underscores the significant financial advantages derived from such connections.

Ethical Considerations and Potential Conflicts of Interest

The lucrative nature of this access raises critical ethical questions. Concerns surround the potential for insider trading and conflicts of interest. Critics argue that the system disproportionately favors those with pre-existing relationships, creating an uneven playing field for investors.

- Transparency: The lack of transparency surrounding these private investments raises concerns about potential manipulation and unfair advantages.

- Fairness: The system arguably favors the wealthy and well-connected, creating a barrier to entry for ordinary investors.

- Regulation: The current regulatory environment might not adequately address the unique challenges posed by private company access.

There's an ongoing debate about the need for stricter regulations to ensure greater fairness and transparency in the private investment market. Some argue for more stringent disclosure requirements to prevent the potential exploitation of inside information. Others advocate for policies that broaden access to private investment opportunities for a wider range of individuals.

Beyond Musk: A Broader Trend in Silicon Valley

This phenomenon isn't unique to Elon Musk's network. Similar patterns are observed across Silicon Valley and other tech hubs, where close-knit circles of investors and entrepreneurs frequently benefit from early access to lucrative investment opportunities. This highlights a systemic issue within the venture capital and private equity landscape.

The Future of Private Company Access: Towards Greater Equity?

The future of private company access is likely to involve a push for increased regulation and greater transparency. Efforts are underway to create a more level playing field for investors, potentially through initiatives such as:

- Increased regulatory scrutiny of private company investments.

- Greater transparency regarding who benefits from these exclusive opportunities.

- The development of platforms that offer broader access to pre-IPO investments.

While the advantages of early access to private companies are undeniable, the ethical considerations and potential for inequity demand careful attention. The ongoing dialogue regarding fairer access and stronger regulations will shape the landscape of private investment in the years to come. The question remains: how can we ensure a more equitable and transparent system for everyone?

Call to Action: What are your thoughts on the ethical implications of private company access? Share your perspectives in the comments below.